Through our web and mobile platforms, individuals can access institutional quality alternative investments, without the high-fees and mark-ups associated with traditional channels.

Our internal software systems allow us to manage hundreds of thousands of individual investor accounts, including handling tax reporting, fund administration, transaction management, all at a fraction of the cost.

We’ve revolutionized the asset management process by leveraging modern data infrastructure tools to unlock real time information, automate reporting, and improve decision making.

We've redesigned each step of the investment management process, replacing high-cost manual work flows with software enabled automated systems. The result is a single integrated platform, providing an entirely unique investment offering to our customers.

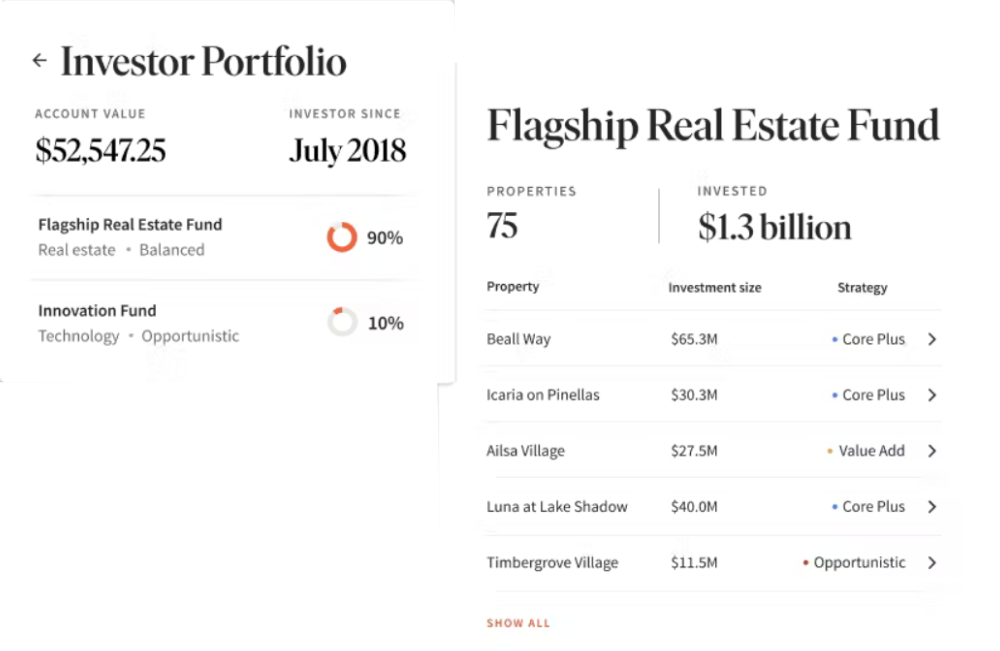

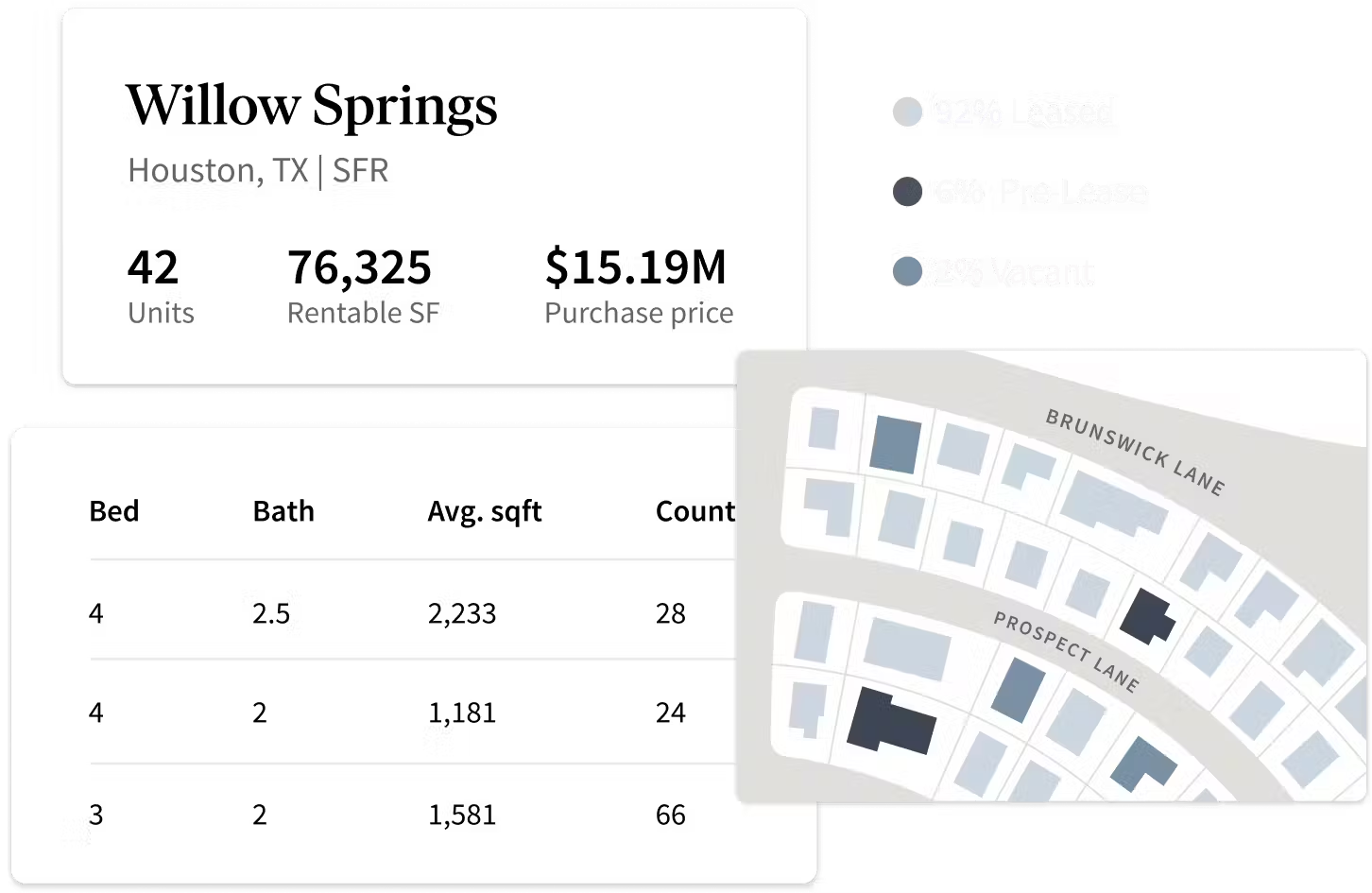

Our internal investor servicing and fund management software system that makes managing 500k investors as simple as managing one.

Our next generation asset management system built on top of a modern data warehouse with real time, automated reporting across hundreds of assets.

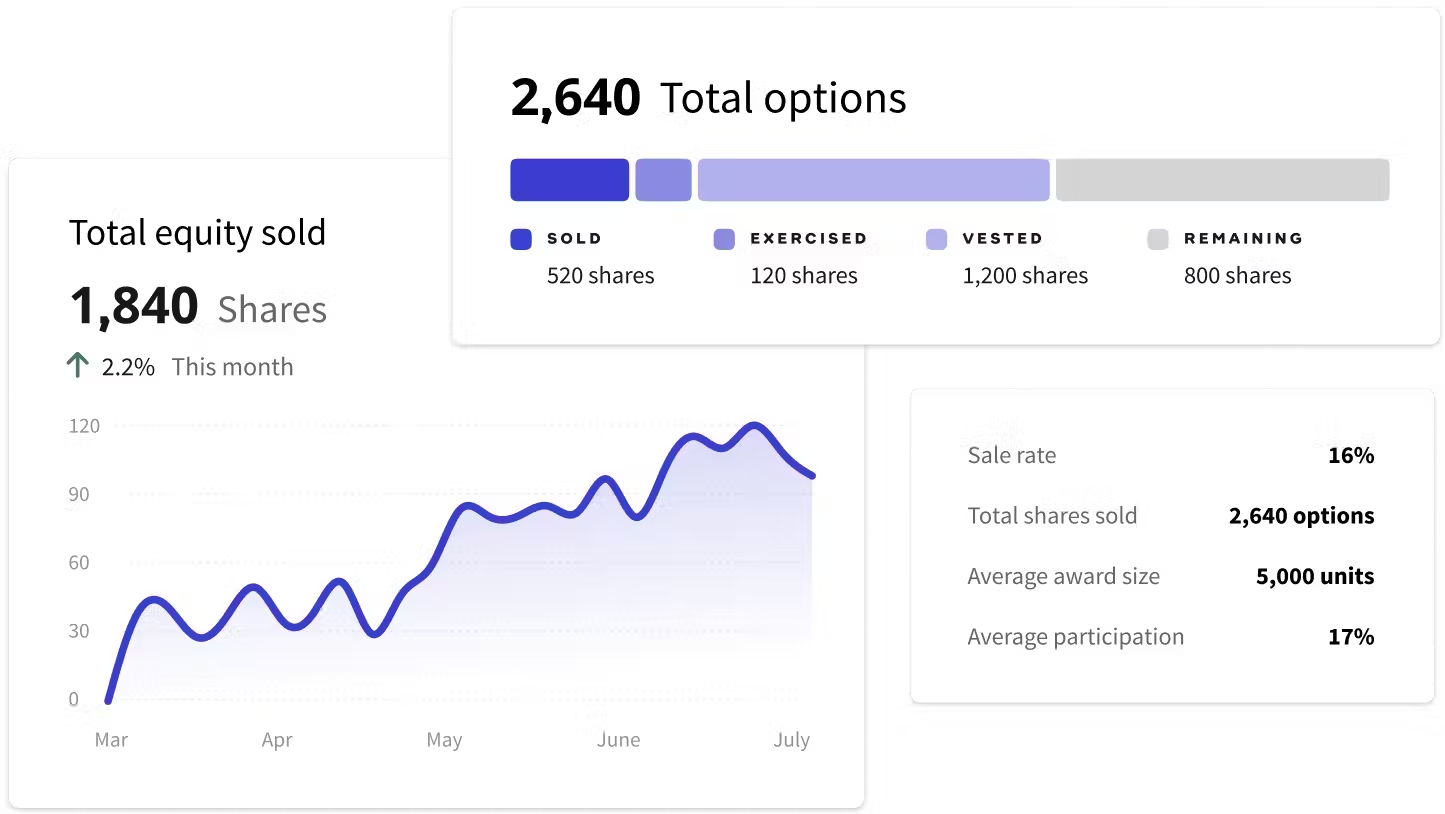

A unique platform providing faster, fairer, and more flexible funding solutions for the best technology companies and their employees.

ARN Capital is designed for long-term investors who want to achieve better than average performance. Our unique integrated technology platform allows us to operate with lower overall costs which means our investors are able to keep more of their returns.

Over the past decade, we've consistently aimed to deliver better returns with less volatility than public market stocks and bonds.

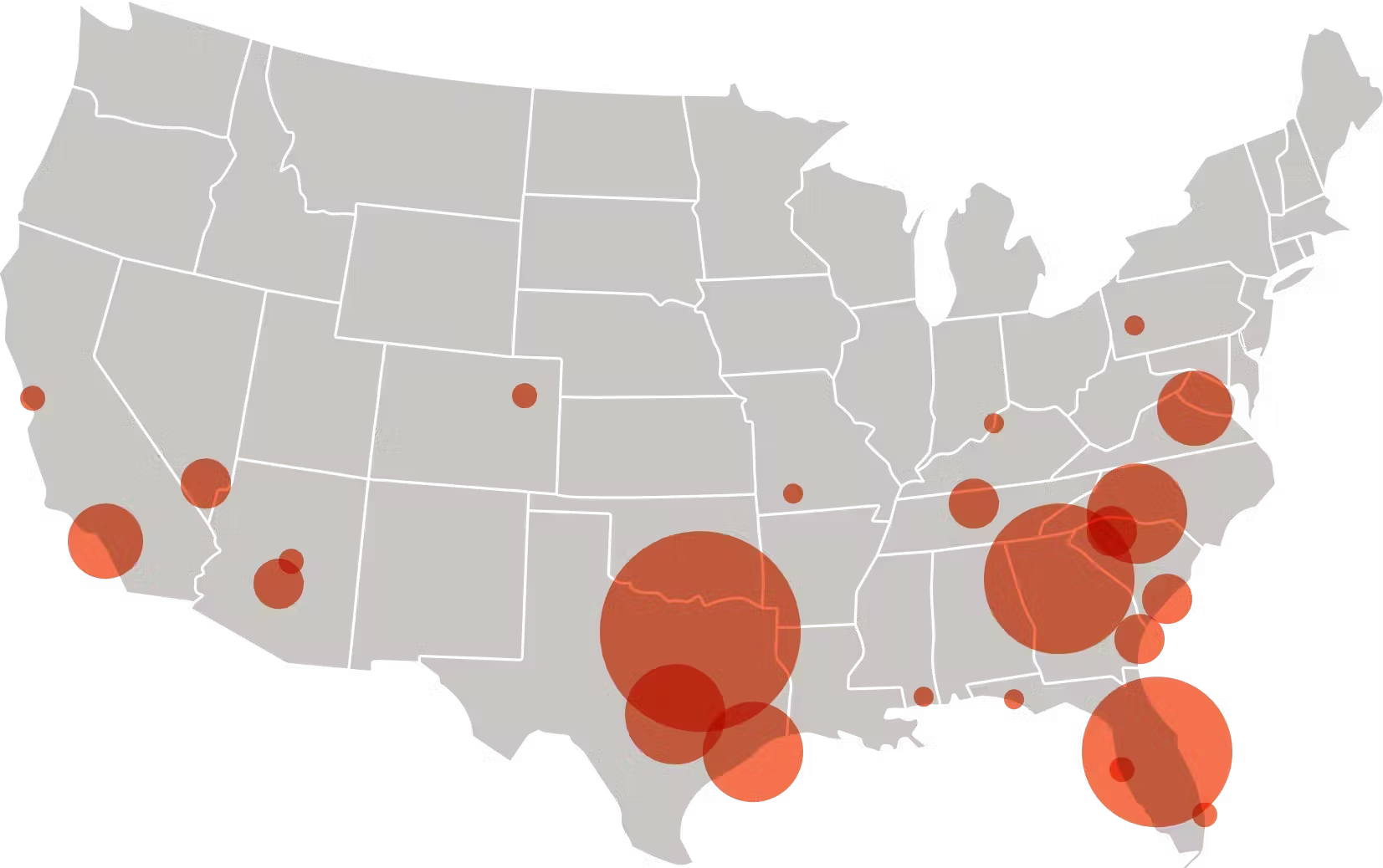

ARN Capital manages $7B+ of real estate* across the country on behalf of our hundreds of thousands of investors.

We deliver institutional quality access and scale through our unique technology platform.

We've eliminated the typical "promote" or "carried interest" performance based fees from our funds open to everyday investors. These fees usually lead to short term decision making and excessive risk taking.

ARN Capital manages a series of funds including Publicly Registered '40 Act Funds and SEC Qualified Regulation A Fund, both of which must provide publicly audited financial statements on an annual basis.

Rather than take traditional VC backing, we’ve created a unique model whereby investors on the platform can become owners of ARN Capital, the company, through our iPO (internet public offering).