ABOUT OUR STARTEGY

Market dislocation creates opportunity

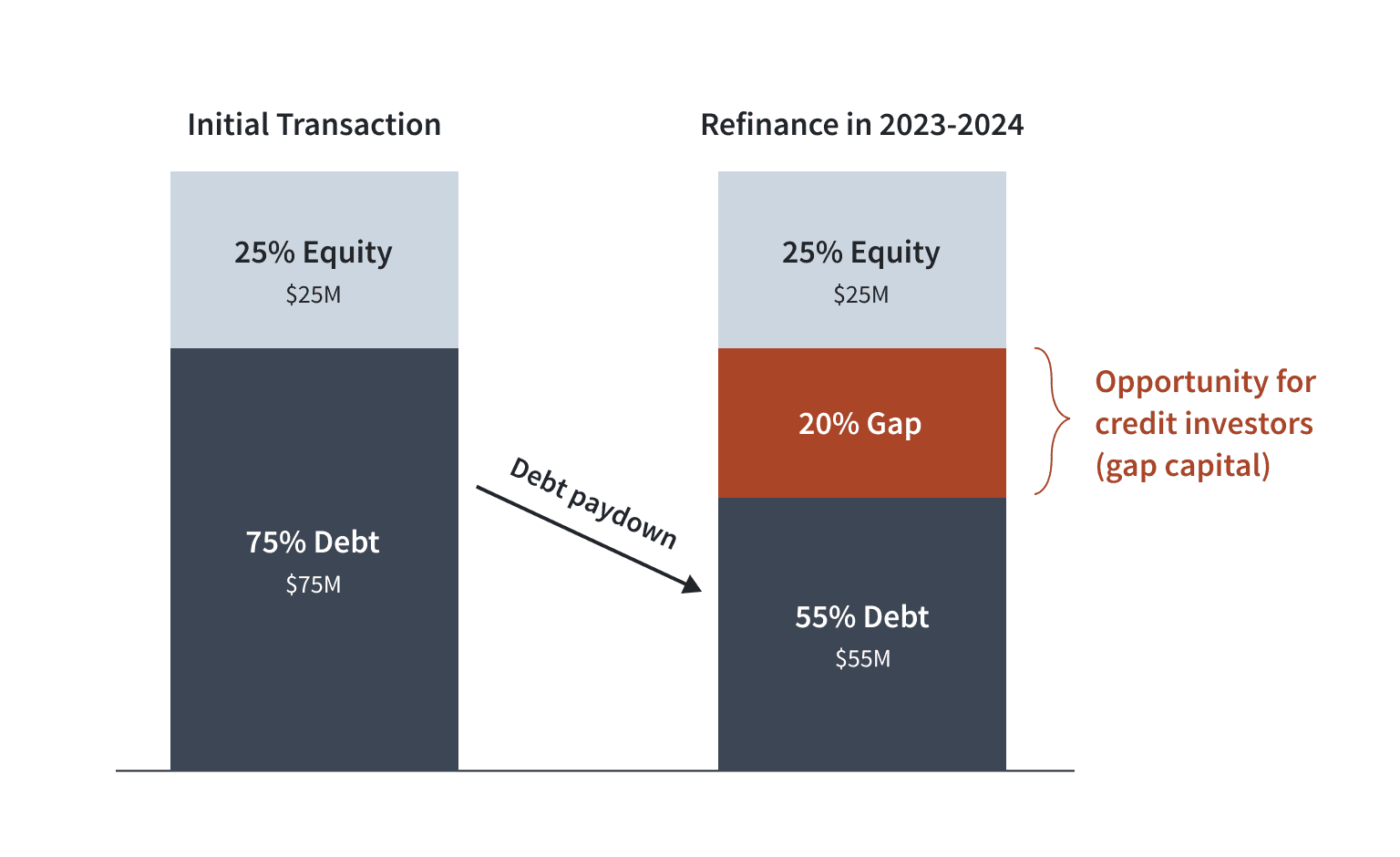

The opportunities created by the Great Deleveraging are unique in that nearly every borrower and every asset (regardless of credit quality) are impacted, hence the name “Great.” No matter who you are, if you were active in business over the past several years then you were inevitably borrowing to some extent. And if you were borrowing at all, then you were borrowing at low rates and relatively high asset values.

Now that the environment has shifted, regardless of the quality of the underlying asset, as loans mature and come due, there will be a gap created during the refinancing period where new equity capital must come in to pay down the overall size of the loan.

Funding the gap

Our strategy is to focus on bridging the funding gap and providing rescue capital to borrowers in the midst of the liquidity crunch. By lending into the gap, we are able to invest at a healthy margin of safety, concentrating on high-quality assets with creditworthy borrowers—those who are experiencing circumstantial liquidity needs as a result of interest rates rising so rapidly through 2022 and 2023.

In these instances, the underlying assets themselves are typically unaffected by the financial turbulence happening in capital markets. Most frequently, the borrower is in the middle of a business plan to enhance the value of the property, such as new construction, renovations, or lease-up, and simply needs more time to reach stabilization and be ready for long-term, fixed-rate debt.

Examples of this kind of activity include:

Originating and structuring real estate loans, including senior mortgage loans and subordinated mortgage loans

Providing mezzanine financing in the form of preferred equity, B-notes, or second trusts

Sizing the mezzanine or preferred loans to a GSE (e.g. Fannie Mae or Freddie Mac) exit

Financing residential construction and development

Acquiring subordinate notes and high-yield investments in the asset backed securities market,—single family rental portfolios, in particular

Focusing on the markets we know best

In terms of location, we will primarily target high-growth markets in the Sunbelt like Dallas-Fort Worth, Phoenix, Orlando, Tampa, Houston, Atlanta, Charleston, and Las Vegas. These are the markets we know the best: approximately 70% of all ARN Capital acquisitions from 2021-2022 were in the four fastest-growing states—Texas, Florida, North Carolina, and Georgia—and more than 90% were within the Sunbelt.

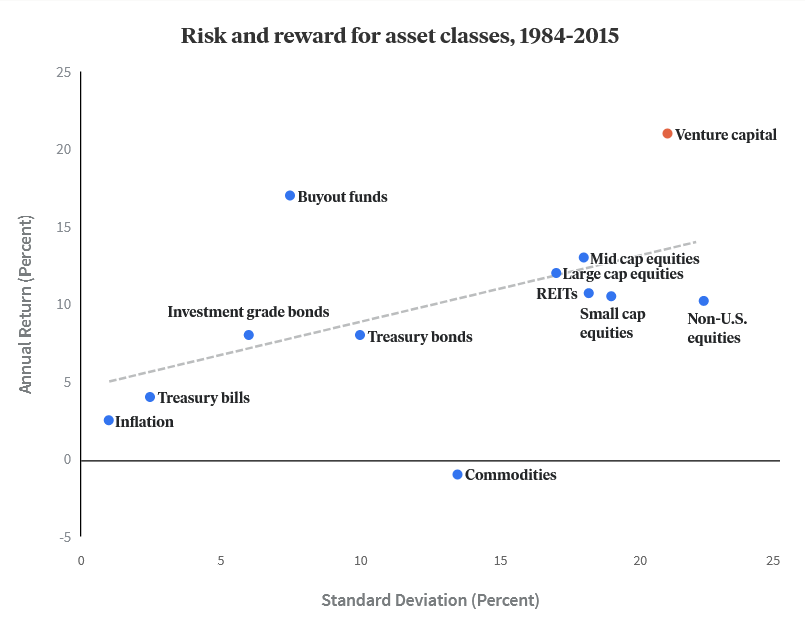

We believe that by maintaining rigorous credit underwriting with a heavy emphasis on residential rental properties, we have the opportunity to achieve some of the best relative risk-adjusted returns since the aftermath of the Great Recession in 2008.