VENTURE CAPITAL

Invest in tomorrow’s great tech companies, today

We aim to give all investors the opportunity to invest in a portfolio of top-tier private technology companies before they IPO.

Sign up

We aim to give all investors the opportunity to invest in a portfolio of top-tier private technology companies before they IPO.

Sign up

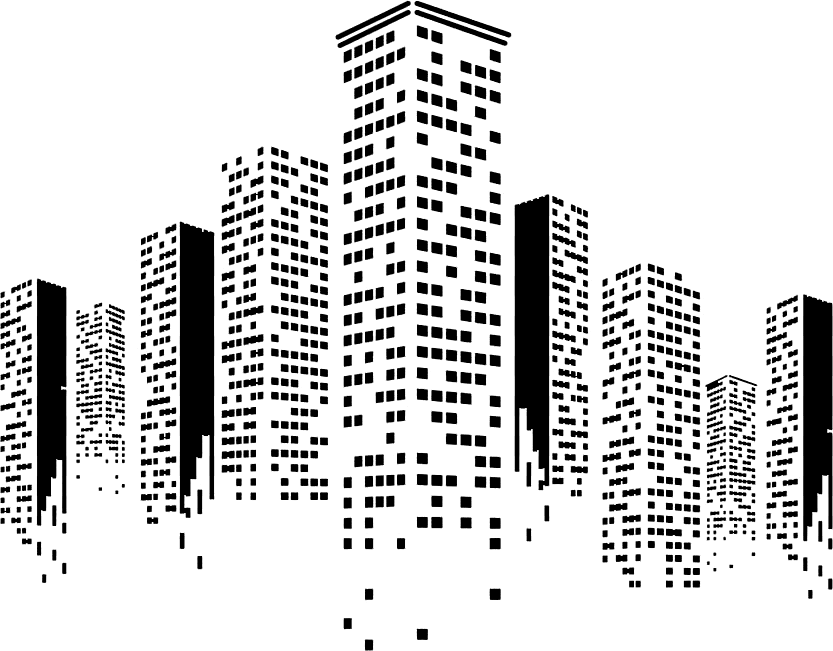

With companies staying private longer, the vast majority of the returns from private tech has accrued to the private investors before the public offering. Plus, access is gated, with hefty tolls, by fund managers and growth equity firms, just as in the real estate private equity world.

During the 90's and early 00's, companies like Amazon and Google went public relatively soon in their growth cycle, while companies today are waiting on average 10 years longer. The result: individual investors confined to the public markets are missing out on a substantial portion of the returns generated by the next generation of industry leaders.

dollars raised

active investors

Our decades of first-hand experience building and operating tech companies gives us a deep understanding of the daily challenges and trade-offs a growing company faces. With over 100 software engineers and product managers on staff, we have more software depth and expertise than most venture funds.

Learn more about our technologyAs the largest direct-to-investor alternative asset manager in the country, we offer portfolio companies in-app exposure to nearly 2 million people—many of whom work in technology. Not only can this potentially drive new customers, recruiting, brand recognition, and near-term revenue for our portfolio companies, it can also provide critical name recognition for when it’s time to IPO.

We’ve engineered our investment infrastructure to enable us to be the most patient and passive source of capital on the market, eliminating any incentive to meddle with a founder/CEO’s long-term vision for the sake of our own short-term image or profits.

Learn MoreJetty offers a unified suite of technology-powered financial products that improve outcomes for both renters and property owners.

Our first proptech investment, Inspectify has a compelling market opportunity and a product that we consider essential to the superior operation of a real estate investment business.

Building on our data infrastructure thesis, ARN Capital is backing the leader in data governance and security access.

A high-growth tech company with a solution that software companies “must have” and a product we believe is 10x better than the old fashioned status quo.