Invest in a better

alternative

Build a portfolio of private assets like real estate, private credit, and venture capital.

Sign up

“ARN Capital is opening the gates to this most privileged of enclaves, marshaling a business model that melds PE-like funds and fintech to help people buy real estate stakes with investments as low as $1,000.”

FORTUNE

For almost a century, regulatory barriers made it difficult for individuals to invest in private markets, giving billion-dollar institutions preferred access. The result has been that most investors have been limited to public markets and excluded from private investments—ranging from real estate to venture capital. Technology is finally disrupting this status quo.1

Enter: ARN Capital, America’s largest direct-to-consumer private markets manager. We built our technology platform to bridge the barrier. Software allows us to achieve the scale of institutions without the bureaucracy. Combining our technology and investment expertise, we are pioneering a new model to build you a better portfolio.

Our $7+ billion investment portfolio* aims to harness the most powerful long-term drivers of the U.S. economy. In today's macroeconomic environment, we believe the ARN Capital portfolio is as well-positioned as any in the world to deliver stable, market-beating returns.

See all historical client returns

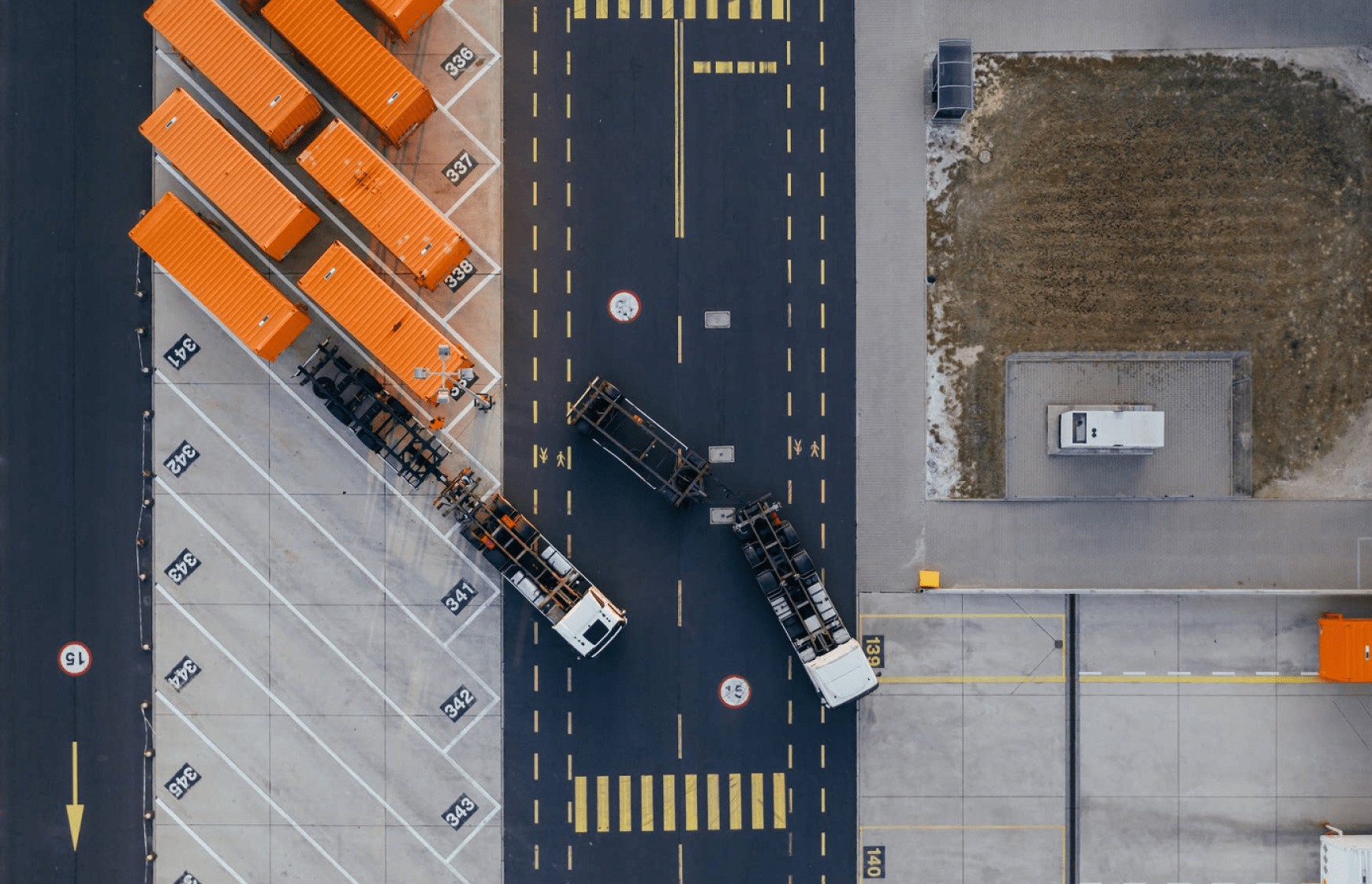

ARN Capital is one of the 50 largest real estate private equity investors in the world by total annual deployment — deploying more than $1 billion of capital annually in 2021 and 2022.

Our portfolio is largely composed of 20,000+ well-located residential units and eCommerce-centric industrial assets.

Investing in high-growth private technology companies has proven to be one of the best performing strategies of the last 50 years.

Our growth equity fund targets mid-to-late stage companies in sectors like Modern Data Infrastructure, FinTech, and AI/ML.

Skyrocketing interest rates have created broad credit market dislocations and a potential liquidity crisis.

The result is arguably the most attractive, risk-adjusted private credit investing opportunity of the last few decades.

We’ve spent 10+ years systematically replacing the industry standard of spreadsheets, PDFs, and expensive 3rd-party vendors with API-driven, fully integrated investor servicing, fund management, and asset management software.

Our end-to-end, fully integrated technology platform is an industry first, drastically reducing operating costs, enabling sophisticated use of data, and delivering improved performance management. The results are dramatic:

An operating system for real estate asset management

An operating system for investor servicing and fund management

A fintech platform to provide more flexible equity funding for the best technology companies and the teams who build them.

Learn MoreOpen a standard account and build a portfolio of alternative investments.

Open your accountWork with an RIA? We can give them access to invest on your behalf.

Invest in your retirementConsidering the fact that we provide the infrastructure for all our clients across the globe, We make it...

Learn More